Between October and November 2018, the Vietnamese State Security Commission (SSC) with the support of VIE/032 project, organised three consecutive consultation workshops on the amended Securities Law in three regions (Danang, Hanoi and Ho Chi Minh city) of Vietnam. The workshops were designed to encourage dialogue and consensus building between relevant agencies, organisations and participants, discuss intellectual property rights and raise awareness of these issues within the framework of the securities market.

The first workshop collected feedback from representatives from the Government Office, National Assembly Economic Committee, Ministry of Justice, Ministry of Finance, Ministry of Security, Securities Business Association, Fund Management Club and securities firms.

The second and third workshops were broader events with mixed public (Economic Board of Consultants to the Prime Minister, Ministry of Finance, SSC and the Securities Law Editorial Board) and private (stock exchanges, fund management companies, auditing companies, banks (supervisory, custodian, settlement), reputable publicly listed companies) sector participants. These workshops were also publicised by the major news outlets in the northern and southern areas of the country.

The Securities Law constitutes the legal framework for the operation and development of securities and was introduced to the public in 2006 and revised in 2010 along with the bylaw documents. According to the Vice Minister of Finance, Huynh Quang Hai, who chaired the two workshops in Hanoi and Ho Chi Minh City, “the Law has contributed to boost the development of the securities market in Vietnam in view of it becoming the long-term capital mobilisation channel for the national economy.”

Figures show that the securities market in Vietnam has boomed over recent years with the number of listed companies having multiplied by 7 between 2016 and end 2017 to reach a current number of 1 537. Market capitalisation for these companies stands at VND 3.8 trillion (about 162M USD) equivalent to 77 percent of GDP, a 55 percent increase on 2016.

According to Mr Hai, “the stock market has efficiently supported an open, transparent capitalisation process for State-owned enterprises (SOEs) which has accelerated the restructuring of SOEs over the past 11 years. Despite the general development of the market, discrepancies and shortcomings of the Law have been exposed and noted. It is therefore now critical to have it updated and revised for an improved legal framework for the management of the stock market”, Mr. Hai insisted.

During the workshops, comments were collected from approximately 330 participants in total and are currently being worked on by SSC and converted into further revisions and updates. Discussions in these forums covered a wide range of issues relevant to the Securities Law although topics such as the organisation of the stock market, public offering, foreign investment attraction, information disclosure, stock business, regulations for securities company/securities investment fund/fund management companies drew the most attention. The revision is also considered to be well aligned with other Laws, mainly Enterprise Law, Investment Law as well as Credit Institutions Law.

The draft (amended) Securities Law, which is supposed to be submitted to the National Assembly in its 7th meeting session in May 2019 and considered for approval in the 8th session in October 2020, is expected to develop a stable, safe and sustainable legal stock market environment. Market supervision requirements, particularly in terms of protecting eligible rights and investor benefits, will ensure that the stock market contributes to mid and long-term capitalisation channels for the national economy,” shared Mr. Nguyen Quang Viet – General Director of Legal Department of SSC during the Ho Chi Minh City workshop.

Amendments to the Securities Law, understood as upgrading securities market legal and governance framework, is one of the three results of Project VIE/032. “The support from Luxembourg’s Government and the active role of Luxembourg Embassy and Lux-Development in this financial sector is highly appreciated,” expressed Mr. Tran Van Dzung, Chairman of SSC. “Many good lessons have been learnt from international experts sourced by Project VIE/032, that have helped us cut short unneccesary steps and head in the right direction of consolidating the amended Law”.

↑ Haut de la page

The prime minister of Vietnam with the book during his speech at the Cao Bang convention centre. In his speech Mr. Nguyễn Xuân Phúc highlighted the importance of market oriented safe agriculture products as a key strategy for economic development.

The prime minister of Vietnam with the book during his speech at the Cao Bang convention centre. In his speech Mr. Nguyễn Xuân Phúc highlighted the importance of market oriented safe agriculture products as a key strategy for economic development.

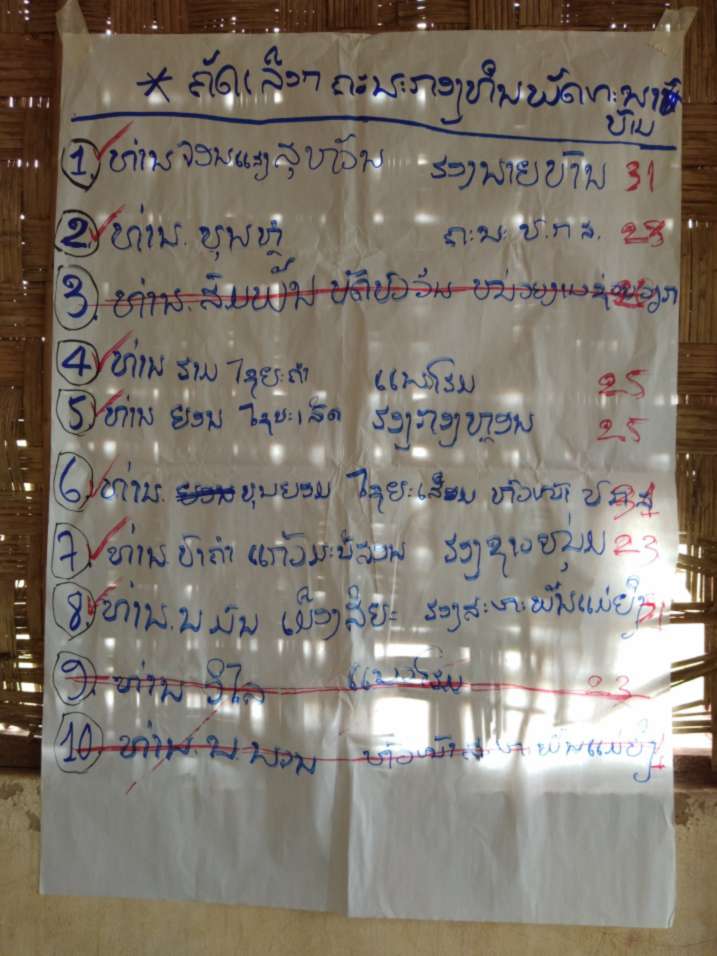

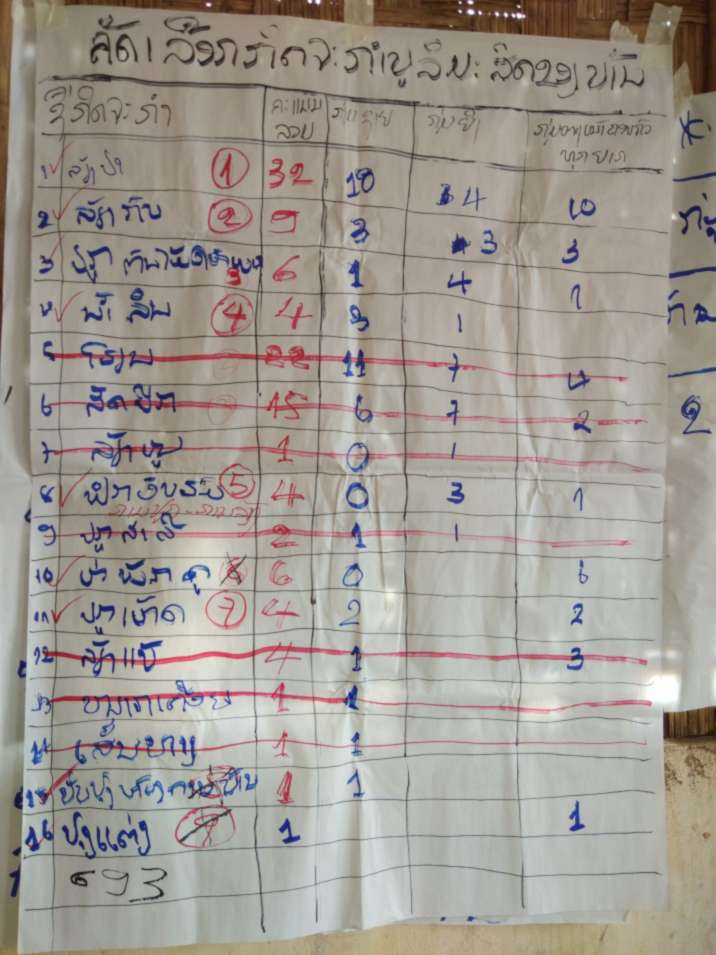

Village Development Fund Committee member explains the village activities implementation plan to the Mid Term Evaluation Team at Khae village, Parktha District, Bokeo province

Village Development Fund Committee member explains the village activities implementation plan to the Mid Term Evaluation Team at Khae village, Parktha District, Bokeo province

Most of the villagers in Tor Lae, Bokeo province are raising local bees as part of their income generating activity from generation to generation.

Most of the villagers in Tor Lae, Bokeo province are raising local bees as part of their income generating activity from generation to generation. Mr Sisouk Khounvithong, on the front row second right, is the Provincial Programme Coordinator and the Deputy Director General of Provincial Planning and Investment Department of Bokeo.

Mr Sisouk Khounvithong, on the front row second right, is the Provincial Programme Coordinator and the Deputy Director General of Provincial Planning and Investment Department of Bokeo.

Dean, Vice-Deans, Heads of various departments and faculty members of the FLP of the National University of Laos posted for a souvenir photo after receiving their certificates on QA workshop

Dean, Vice-Deans, Heads of various departments and faculty members of the FLP of the National University of Laos posted for a souvenir photo after receiving their certificates on QA workshop

© Phoonsab Thevongsa

© Phoonsab Thevongsa © Phoonsab Thevongsa

© Phoonsab Thevongsa © Phoonsab Thevongsa

© Phoonsab Thevongsa