VIETNAM - Luxembourg continues supporting Vietnam’s Securities Market Development Strategy for 2021-2030

With continual and fast growing stock market in Vietnam, Vietnamese securities regulators are paying their great attention to the next development of the Securities Market Development Strategy for 2021-2030 which is responsible by the State Securities Commission (SSC). The expected strategy heads to a more comprehensively structured, more open and integrated as well as more competitive plus resilient market.

Virtual forums are quite efficient in gathering comments and opinions from experts all over the world during COVID-19 times.

Virtual forums are quite efficient in gathering comments and opinions from experts all over the world during COVID-19 times.

To this effort under the VIE/032 project scope, Luxembourg has played key role and so far only a mobiliser of technical assistance in supporting this action.

From 06 to 19 April 2021 the SSC in Hanoi organized 07 continuous virtual meetings focused on various key topics including

- securities trading markets and development of products;

- securities registration, depository, clearing and settlement;

- development of securities companies;

- fund industry;

- supervision, inspection and sanctions; and

- international integration.

The participants from Ho Chi Minh City Stock Exchange (HOSE), the Hanoi Stock Exchange (HNX) and the Securities Depository Centre (VSD), Securities Research and Training Center (SRTC) and technical departments of SSC attended the meetings.

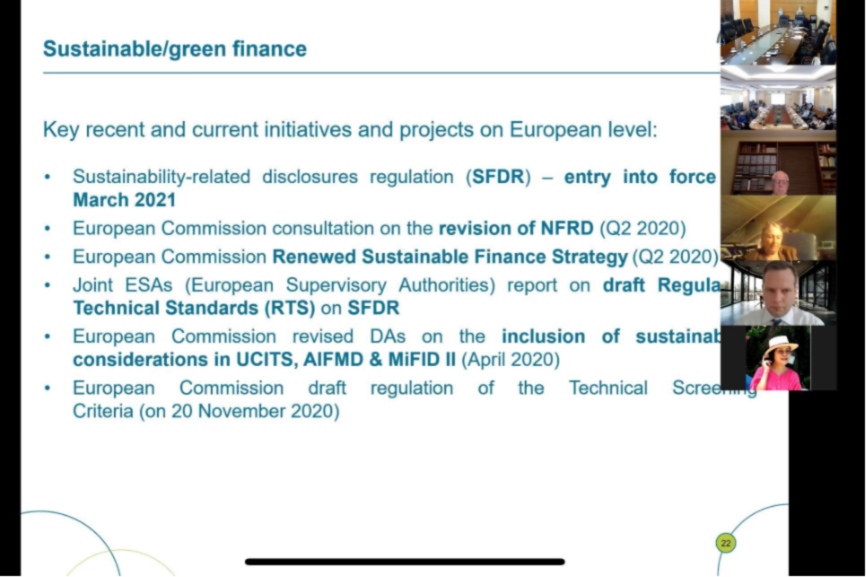

Sustainable and green finance attracted great attention from regulators and market stakeholders in Vietnam during elaboration process of Securities Development Strategy

The workshop was facilitated by international and regional advisors who are from the Association of the Luxembourg Fund Industry (ALFI), Luxembourg Institute of Directors, and Luxembourg Blockchain Association, the United States, and Thailand. The meetings provided the opportunities to the participants to exchange ideas, share best experiences and lessons learnt from world market as well as recommendations for the Vietnam’s market direction.

The workshops discussed sustainable finance opportunities for Vietnam, in line with Ministry of Finance’s direction. This is also an obvious advantage from Luxembourg as a hub of global financial market, where Vietnam could much benefit from exploring and learning from its broad experiences and advanced practices.

According to Pierre Oberlé, Senior Business Development Manager at ALFI: “sustainable finance will become the norm and investors will be keen to pay or to integrate the additional costs that this type of product has to deal with.”

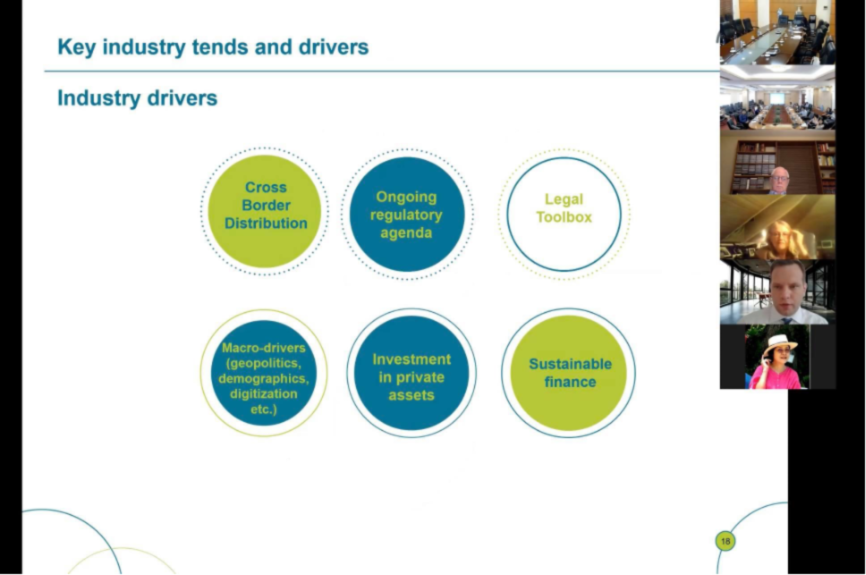

Luxembourg Fund Industry practice

Luxembourg Fund Industry practice

Oberlé also pointed out in one of the virtual discussions with SSC that when it comes to attract foreign investors into the sustainable market in Vietnam, the country would first need to access what type of assets its currently has, which meet the sustainable finance criteria and norms in different jurisdictions. Additionally, Vietnam ought to develop the expertise necessary for the sustainable financial market development, in terms of market capacity and human resource training.

As a number of complex issues were raised, discussed and cleared during these online forums thanks to the straightforward exchanges by the participants and the advisors, the SSC gladly welcomed all comments and recommendations contributed. Mr. Pham Hong Son, Vice Chairman of SSC who chaired the overview session expressed: “we highly appreciated the support from Luxembourg Government to the SSC of Vietnam, that has been well managed and implemented by LuxDev, particularly shown via these interactive and fruitful workshops. We have learnt a lot.”

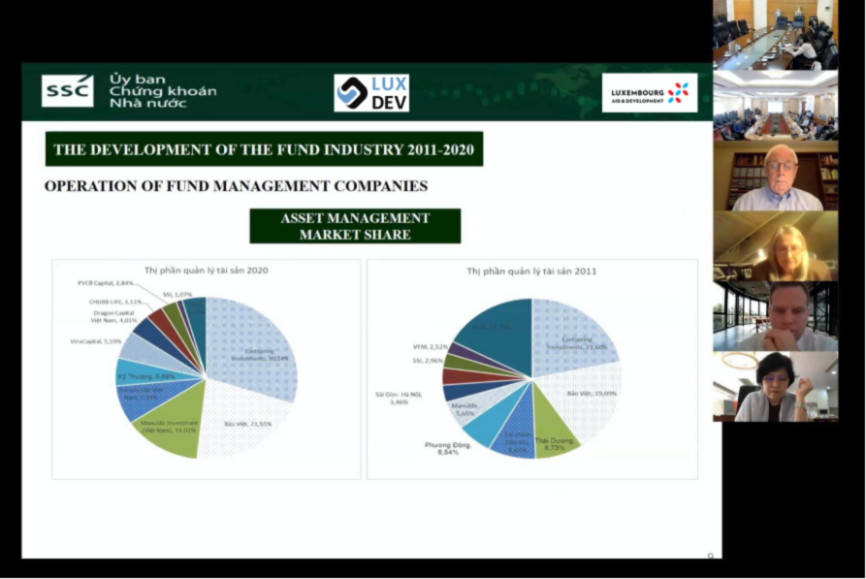

A brief overview of Vietnam Asset Management Market Share

A brief overview of Vietnam Asset Management Market Share

The Strategy is now being consolidated as it is expected to receive comments from relevant market stakeholders in May and thereafter to be submitted for approval from Ministry of Finance on 2nd June 2021.

The Capacity Building in the Financial Sector – VIE/032 project is co-financed by the Government of Vietnam and the Grand-Duchy of Luxembourg and is implemented by the Vietnamese State Securities Commission and LuxDev, the Luxembourg Development Cooperation Agency.

↑ To the top